TRANSMISSION OF SHARES

Transmission of shares at times is highly clumsy and runs into many legal complications.

We help our clients by providing solutions and services relating to entire range of transmission of shares.

A few common issues that we come across frequently are mentioned below:

How We Can Help You

Holding shares of various companies: In case the deceased shareholder had holdings in different companies, the relevant documents must be sent to each of the companies along with the share certificates in order to effect transmission of shares. This needs constant follow-up with each of the companies.

Mixing up transfer of shares with transmission of shares: One of the widely experienced problem is not to find out the difference between transfer of shares and transmission of shares. The Companies Act clearly discriminate transfer of shares from transmission of shares. While transfer of share relates to a voluntary act of the share holder and transmission is brought about by operation of law. In case of transfer, shares are transferred without any consideration and In case of transmission, its considered on the basis of will or an agreement.

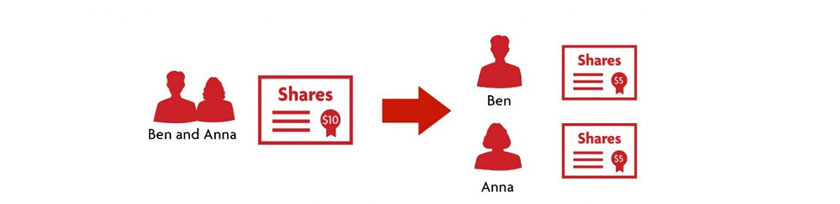

Jointly held securities: Problems also arise, if deceased was one of the joint holders. In that case, the surviving holders must have a depository account and apply for transmission of shares following the adequate procedures.

Share transmission is the dispersal of title of shares of share holder due to death, inheritance, insolvency, bankruptcy, marriage or by any other lawful means other than transfer.

Share transmission is the dispersal of title of shares of share holder due to death, inheritance, insolvency, bankruptcy, marriage or by any other lawful means other than transfer. On registration of the transmission of shares, the person becomes the share holder of the company and is entitled to all the rights as a share holder.